Electrical Contractors Insurance

Essential protection for your Electrical business

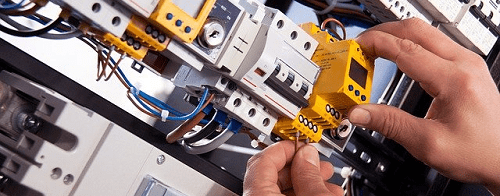

No two days are the same when you’re working as an electrical contractor. One minute you’re rewiring a domestic property, the next you’re installing complex three-phase systems in a new factory build. Whether you’re a general electrician or a specialist working in renewables, Electrical Contractors Insurance is a vital part of your business protection.

At Real Insurance Group, we specialise in arranging tailored insurance for electrical professionals across the UK. We’re not a call centre – we’re a dedicated team of commercial insurance brokers who understand your trade and are here to give real advice, with real expertise.

What is Electrical Contractors Insurance?

Electrical Contractors Insurance protects your business against the unexpected. The core of the policy is Public Liability Insurance, which covers legal fees and compensation costs if you or your business causes injury to a third party, such as a member of the public, or damage to their property.

If you employ anyone – even labour-only subcontractors or casual workers – you’re legally required to have Employers’ Liability Insurance in place. This protects you if an employee makes a claim due to a work-related injury or illness.

Who needs Electrical Contractors Insurance?

Whether you’re a sole trader fitting extra sockets or a large commercial contractor working on complex installations, you need insurance. Electrical contracting comes with a wide range of risks, and the right cover can help protect your business, your equipment, and your people.

We cover a broad range of professionals in this field, including:

What type of insurance cover does an Electrical Contractor need?

Certain types of insurance cover are essential, sometimes main contractors may require you to prove that you have cover in force. Public Liability, as well as Employers Liability, is necessary at times even to get on site. Main contractors responsible for factory installations or new build housing estates or building refurbishments may ask you to meet certain criteria, typically this might be Public Liability indemnity limits.

What are Public Liability Indemnity Limits?

When you take out Public Liability Insurance for your electrical contracting business you will need to set what’s called an indemnity limit. This is the maximum amount an insurer will pay in the event of a claim against you. Different limits are available, usually starting at £2million and rising from there, £5million, £10million and upwards.

There are situations where a minimum amount is required, this may be specified by the main contractor for instance, so that is usually an easy choice for you to make. Insurance for businesses in the electrical contracting sector shouldn’t be based on premium, you need to carefully assess your needs, just working on single domestic homes you might consider that £2million is sufficient, large or complex commercial properties or higher risk locations you might consider you need more cover.

Speak to us about your requirements, we can go through your various needs with you and assist you in your decision process.

Does a Public Liability Insurance Policy have excesses?

An electrical contractor’s public liability insurance policy can have an excess, referred to as a third party property damage excess. The amount can depend on certain factors, the insurer’s policy minimum, the level of risk, and even previous claims.

An excess is the first part of a claim that the insurer won’t pay, this works very similarly to how a car insurance excess works.

Are there other Liability Insurance covers available for an Electrical Contractor?

Depending on your area of specialism there could be various types of insurance covers that might be required.

Right from the planning stage, there is the risk of error even with the best minds on the job, Electrical Contractors Professional Indemnity Insurance not only covers you at the design stage but can protect you against errors throughout the installation stage too.

Sometimes even with the best plans, systems or installations can fail to work as they are intended, this might be through bad design or a badly placed piece of equipment, Efficacy Insurance covers usually (or should) come as standard on an electricians insurance policy, an essential cover that every electrician or electrical business should have. This provides cover where it is alleged that the work that has been done fails to perform its intended function, a bad placement of a security detector installed by an alarm technician obscured by a vehicle could be a typical example.

Does an Electrical Contractor or Electrician need insurance by law?

That really does depend. If you have anyone working for you, even if on a casual basis, you will need Employers Liability insurance. Employers Liability is likely to be a condition of your contract with either the main contractor or the customer, too.

If you have a van or a fleet of vans then the other compulsory insurance is insurance to cover the vehicle for use on the road.

For most businesses these are the two compulsory insurance requirements, outside this insurance is not a legal requirement to have, however, the financial consequences are considerable.

Additional Insurance Options for Electrical Contractors

Hand & Power Tool Insurance – Covers theft or damage to your essential tools, whether on-site or in your vehicle.

Contract Works Insurance – Sometimes this type of insurance cover may be a condition of your contract to ensure that the works that you are doing are fully covered by you or your company. This might include cover for damage to works that you have already done as well as materials yet to be installed such as cables, lighting, and other electrical hardware. A contractor’s all risks insurance or contractor’s combined policy can cover many items including plant and equipment that you have hired in.

Own Plant & Equipment Cover – Over the years you may have built up quite a collection of plant and equipment that are essential to your business activities. These items can be insured not only on-site but when at your business premises if you have them or in transit to and from sites.

Hired in Plant Insurance – Often you might need access equipment, for example, installing high-level lighting or cabling systems, if you don’t use specialist tools and machinery all the time then hiring in plant such as cherry pickers, scissor lifts or specialist hand tools such as disk grinders is the most cost-effective way to go. In many instances, you are responsible for the plant if anything was to happen to it, so it’s prudent to ensure this is covered either by purchasing the hirer’s insurance cover if that option is available to you or, you can take out a separate annual hire insurance policy – speak to us about the best type of hired in plant policy to suit your needs.

Business Legal Expenses Insurance – Any business can be exposed to all manner of legal issues, these might be disputes with suppliers or customers contracts, property issues, employee problems as well as HMRC disputes. They can provide legal helplines as well as a vast array of legal documents for you to use in your business.

Personal Accident Insurance – Whether you are a single contractor who is dependent on being able to work or a large electrical contracting business insurance for your employees can mean you can continue to pay them if they are not working due to injury or accident.

Why use Real Insurance Group for your business insurance?

Real Insurance are specialist commercial insurance brokers dealing with businesses only in certain sectors of industry, we are not everything to everyone, and we don’t set ourselves out to be either.

We can walk you through what’s available to protect your business, advise on specific covers that are available specifically on electrical contractors’ insurance policies, many specific to the contracting sectors.

Speak to us today about your requirements, you will be speaking with knowledgeable commercial insurance specialists with many years in the industry, importantly we are not a call center.