Air Conditioning Contractors Insurance

Insurance for HVAC Specialists

Air Conditioning Contractors Insurance

When your business is about keeping your customer’s “temperature happy”, there is no need for you to get hot under the collar when it comes to your air conditioning contractors’ insurance.

Most businesses understand that Public Liability Insurance is one of the key business protections, it provides essential protection against allegations from a third party, such as a member of the public or one of your employers that you have caused damage, loss, or even injury. It provides both legal defence costs as well as compensation to the claimant should you or your business be found responsible.

Do I need insurance for my Air Conditioning Business?

Heating, Ventilation, and Air conditioning, or HVAC for short, of course, come in all shapes and sizes, whether you are a single sub-contractor specialising in refrigeration or a larger entity covering the full spectrum of air-con services, your risks are just the same, you can have just the same exposures.

Having insurance in place isn’t just about keeping your employer happy, whether that is a private individual or a main contractor. Liability insurance for air conditioning engineers and contractors can also include employers’ liability insurance, tools, and plant cover as well as Professional Indemnity which is essential when you are designing and installing HVAC systems.

What is Air Conditioning Contractors Insurance?

Insurance is all about protection so it’s prudent that you look at various alternatives being offered, whether online where advice is not provided or from an insurance broker who specialises in the construction and contracting trades such as Real Insurance Group.

Like many things in life, quality is remembered long after price, the important point is that you get the cover that correctly covers the exposures of your business.

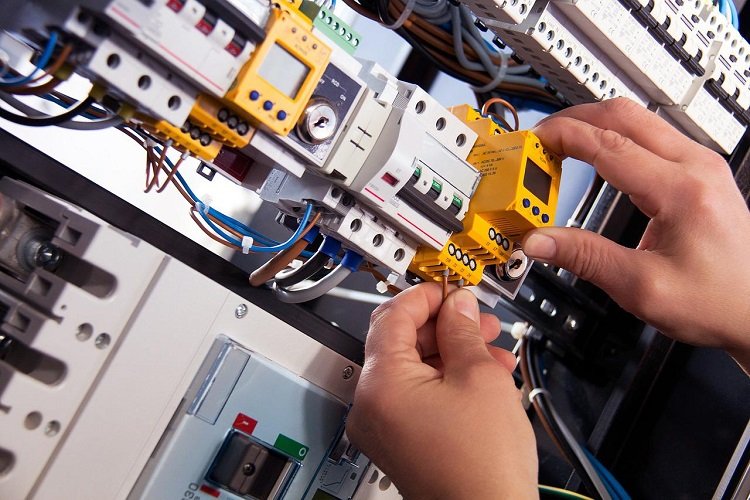

Because the Air-Con sector is so wide, your business can be dealing with cooling, heating, and generally keeping people at an ambient temperature, you can be working in confined spaces, at heights whilst installing the latest new energy-efficient air conditioning systems.

Insurance for the air-conditioning sector usually starts with the most important cover whilst working on other people’s property, Public Liability Insurance, just in case you damage anything or injure someone. Whilst many policies might be badged specifically for the sector, they are in fact many standard covers usually brought together in one place.

Whilst Public Liability is the core cover, like most businesses there becomes a point where it’s essential that you employ people to help you in the business. This is where Employers Liability is not only essential but a statutory requirement, meaning that you are required to have the cover by law.

What is employers’ Liability Insurance?

Unlike Public Liability, Employers Liability is a legal requirement, instead of providing cover for any loss or damage that you might do to the public, Employers Liability will provide cover against actions that might be taken against the business for injury or illness whilst the employee is working for you.

The cover is not only to defend the business against potential large compensation claims but to also provide legal costs and expenses up to the indemnity limit, usually £10million but it also includes any compensation that might be payable too.

Professional Indemnity Insurance for Air Conditioning Contractors

Certain types of trades require specialist covers, whether you are specialist heating engineer, refrigeration, or ventilation contractor it’s highly likely that you will be designing HVAC systems at some point?

This is where specialist insurance covers become a specific requirement, Professional Indemnity is one of these covers that should be considered, some insurance policies come with this type of cover included, and even though it may be a very low limit it’s still valuable to your business, but that depends on what type of cover is being given.

Professional Indemnity insurance can be a little confusing, it’s not a public liability cover, it covers you for breach of professional duty or care. It’s important to understand though when purchasing this type of cover what is being provided as there are different types of cover available. As an example, in its simplest form PI Insurance just covers you for wrongful advice, for air conditioning contractors though it’s likely that you would not only design systems but carry out the installation too, this type of professional indemnity is referred to as Design & Construct.

Speak to us at Real, being specialists in this market we have access to many insures, we can discuss, advise, and guide you through the covers you require for your business.

How much Insurance cover should I buy?

Whether it’s Public or Employers Liability or Professional Indemnity that is required, all have something called an indemnity limit. An indemnity limit is a limit up to which your insurer will pay in the event of a claim, this can be inclusive or exclusive of legal costs so it’s always important to know what you are covered for, we can help you with the indemnity limits.

How do I choose a liability insurance indemnity limit for my business?

Public Liability, £2million is very common now, although lower limits are available, £5million is an option and becoming quite standard, much higher limits are available, £10million and upwards, sometimes the limits are decided by your employer.

Your employer could be a domestic homeowner that you are fitting Air Conditioning for, they might not require a specific amount and only insist that you have cover in place. If you work for the main contractor though, also referred to as your employer, you might find that they say how much you need before you are allowed on their site.

Employers Liability, although £5million is the minimum required by law, the standard provided by insurance companies is usually £10m, if you are only given £5m it might be prudent to question why?

Professional Indemnity limits can vary hugely typically starting at £50,000 where a specialist HVAC Contractors insurance policy might include it, this limit will afford you some cover but it’s better to establish how much you really need, what is your employer asking, what is the largest contract size, what exposure might you have to a claim, these are all questions that need to be asked to ensure that you have sufficient cover in place.

Selecting an indemnity limit can be difficult, discuss with our construction team here at Real Insurance about your needs, and we can provide advice as well as give you guidance on these sometimes-difficult questions.

Does Liability Insurance have an excess?

Just like you might have on your car, Public Liability and Professional Indemnity Insurance will have excesses, some are small amounts, however at times and depending on many factors such as whether using any heat such as blow lamps, hot airguns, and even angle grinders or you are working at heights such as installing air conditioning heat exchangers at high levels, installing, repairing or maintaining commercial systems in high-risk premises. These are called third-party property damage excesses and are payable if loss, damage, or injury occurs to a third party.

Employers Liability Insurance should not have an excess if it does you might wish to question why!

Is Air Conditioning Contractors insurance expensive?

There are many factors that go into obtaining insurance for your business, including indemnity limits, whether you use heat or not, what heights you go to and in some instances, depths, confined spaces, and even the types of premises you work on.

Depending on what type of business you are can depend on the premiums and the covers provided, a sole trader may have something called a “Per Capita” insurance policy, as the name suggests this is based on the number of people in the business, you just buy cover for the number of people, usually those that work manually in the business.

For larger businesses, these could typically be rated on the Wages and the Turnover which can give much more flexibility, particularly if you are employing Labour Only Sub-Contractors or the services of Bona Fide Sub Contractors.

Air-conditioning contractor insurance can incorporate a wide spectrum of disciplines within the sector.

HVAC Contractors

Refrigeration Engineers

Ventilation Engineers

Air Conditioning Contractors

AC Installers

Air Conditioning Engineers

If your business is about keeping the ambiance, whether hot or cold, speak to us about your insurance requirements, we have access to insurer markets that specialise in air conditioning and ventilation, refrigeration, and more modern air-source systems.

Can I cover my materials on a construction site?

Air Conditioning Contractors insurance can incorporate other covers, protecting your materials on site is an example. With air conditioning equipment being expensive to buy, consider what the cost would be if the delivery of units, ducting, and control systems as well as expensive non-ferrous metals such as copper were stolen from a site? Who is going to pay for this?

Insurance is available to cover these types of eventualities, usually covered under what’s called a Contract Works Insurance policy. As the name suggests this covers the works, besides the obvious theft of materials, there could be a fire, storm damage, and other risks that could prove very expensive if you don’t have cover in place to protect your business.

Can I cover my plant tools and machinery on-site?

Tools used can be expensive, as can some plant and equipment, Air Conditioning Commissioning Kits, Power Drills, employees’ tools, and equipment, and even Hired in Plant can all be thief attractive so it’s prudent that insurance is considered for these items.

Hired in Plant can be crucial for some jobs, did you know that when you hire equipment from your local hire shop that if you don’t take their insurance, you could be wholly responsible for it if anything was to happen to it, this could prove very expensive. The cover is available and could cost far less than many of your tools.

When it comes to Air Conditioning Contractors Insurance it’s important that you speak to a specialist broker, not only someone that has the knowledge and understanding of what your business does but to provide that all-important balance between the extent of cover as well as the premium cost to obtain it.

Why should I deal with Real Insurance?

Firstly we don’t leave you to fend for yourself with online portals and quote systems, nor are we a call center, both have their place but we believe that obtaining your insurance through a broker such as Real Insurance Group provides you with knowledgeable and experienced insurance experts, some of the team have been broking for decades so you know you are in safe hands.

Call us now on 0330 058 0260 or ask us to contact you.